Loading ...

Loading ...

Loading ...

86 APPENDIX - Reference Information

where:

Net present value depends on the values of the initial cash flow (

CF

0

),

subsequent cash flows (

CF

j

), frequency of each cash flow (n

j

), and the

specified interest rate (

i).

IRR = 100 i, where i satisfies npv() = 0

Internal rate of return depends on the values of the initial cash flow

(

CF

0

) and the subsequent cash flows (CF

j

).

i = I/Y 100

Bonds

1

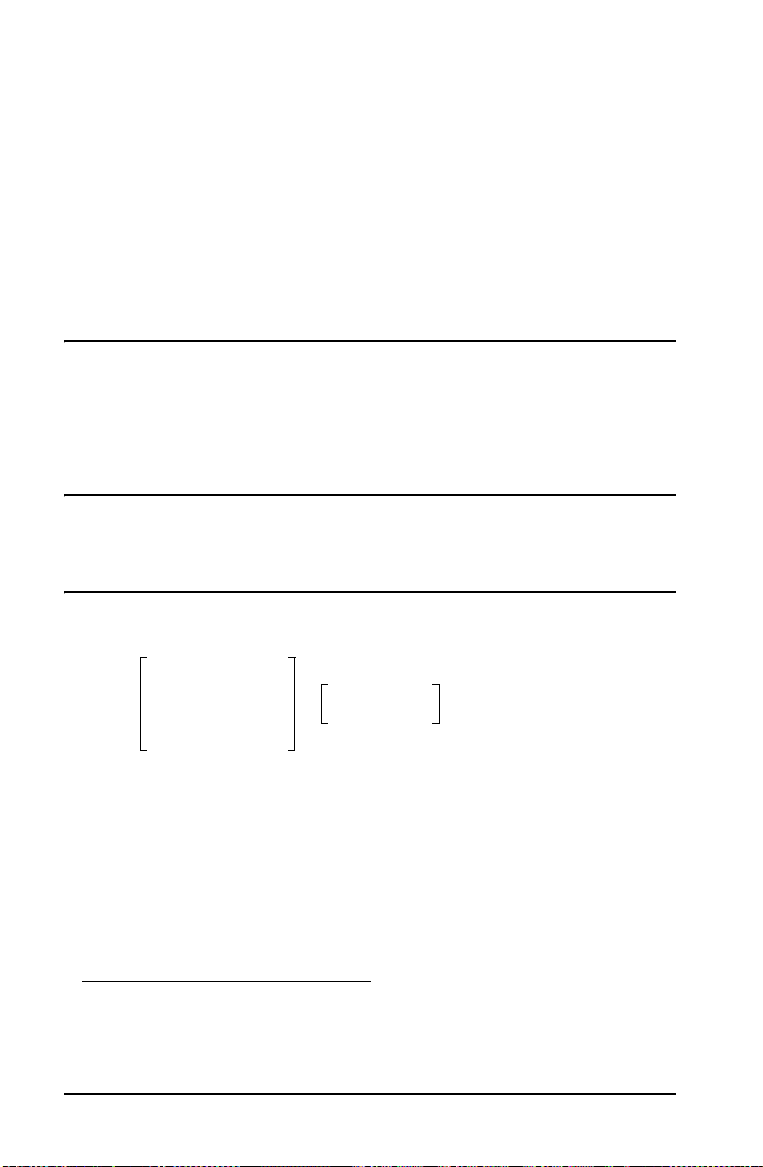

Price (given yield) with one coupon period or less to redemption:

where:

PRI =dollar price per $100 par value

RV =redemption value of the security per $100 par value (RV =

100 except in those cases where call or put features must be

considered)

R =annual interest rate (as a decimal; CPN _ 100)

M =number of coupon periods per year standard for the

particular security involved (set to 1 or 2 in Bond worksheet)

DSR =number of days from settlement date to redemption date

(maturity date, call date, put date, etc.)

1.Source for bond formulas (except duration): Lynch, John J.,

Jr., and Jan H. Mayle. Standard Securities Calculation Meth-

ods. New York: Securities Industry Association, 1986.

S

j

n

i

i 1=

j

j 1

0 j 0=

=

PRI

RV

100 R

M

------------------

+

1

DSR

E

-----------

Y

M

----

+

--------------------------------------

A

E

---

100 R

M

------------------

–=

Loading ...

Loading ...

Loading ...