Loading ...

Loading ...

Loading ...

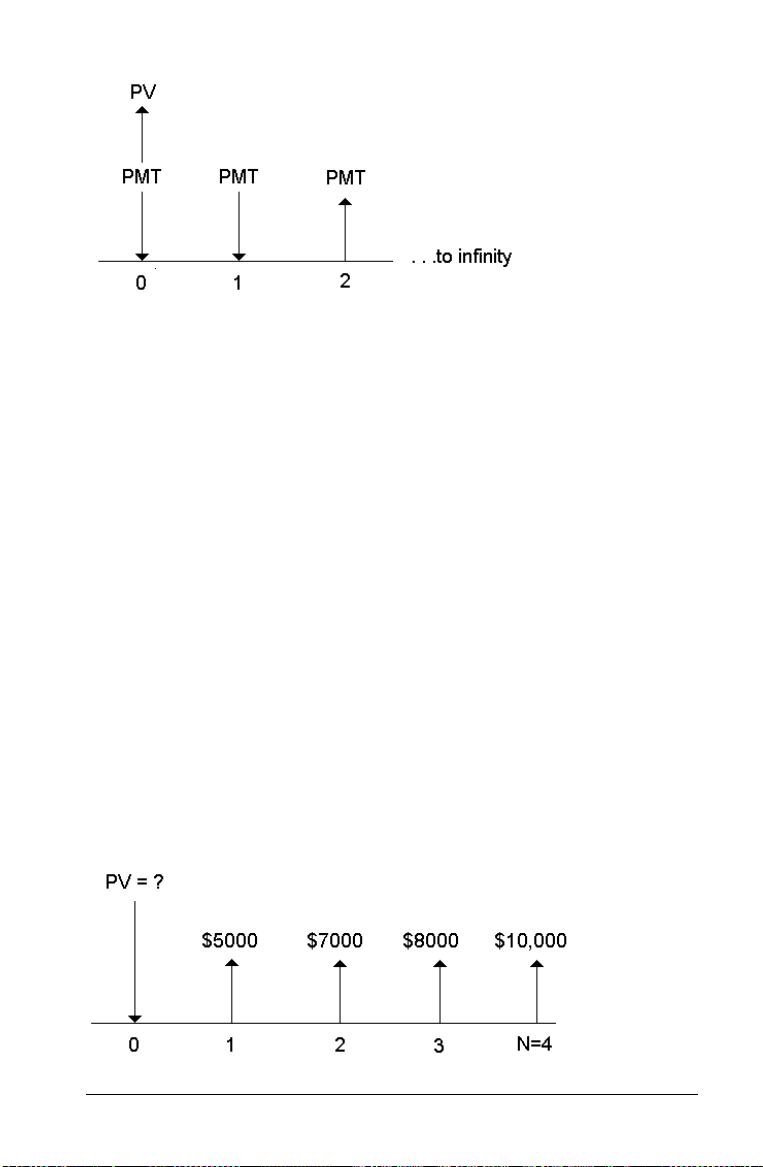

Time-Value-of-Money and Amortization Worksheets 31

Because the term (1 + I/Y / 100)

-N

in the present value annuity equations

approaches zero as N increases, you can use these equations to solve for

the present value of a perpetual annuity:

• Perpetual ordinary annuity

• Perpetual annuity due

Example: Computing Present Value of Variable

Cash Flows

The ABC Company purchased a machine that will save these end-of-year

amounts:

Given a 10% discount rate, does the present value of the cash flows

exceed the original cost of $23,000?

Year

1234

Amount

$5000 $7000 $8000 $10000

PV

PMT

I/Y100

---------------------------

=

PV PMT

PMT

I/Y100

----------------------------

+=

Loading ...

Loading ...

Loading ...