Loading ...

Loading ...

Loading ...

Time-Value-of-Money and Amortization Worksheets 33

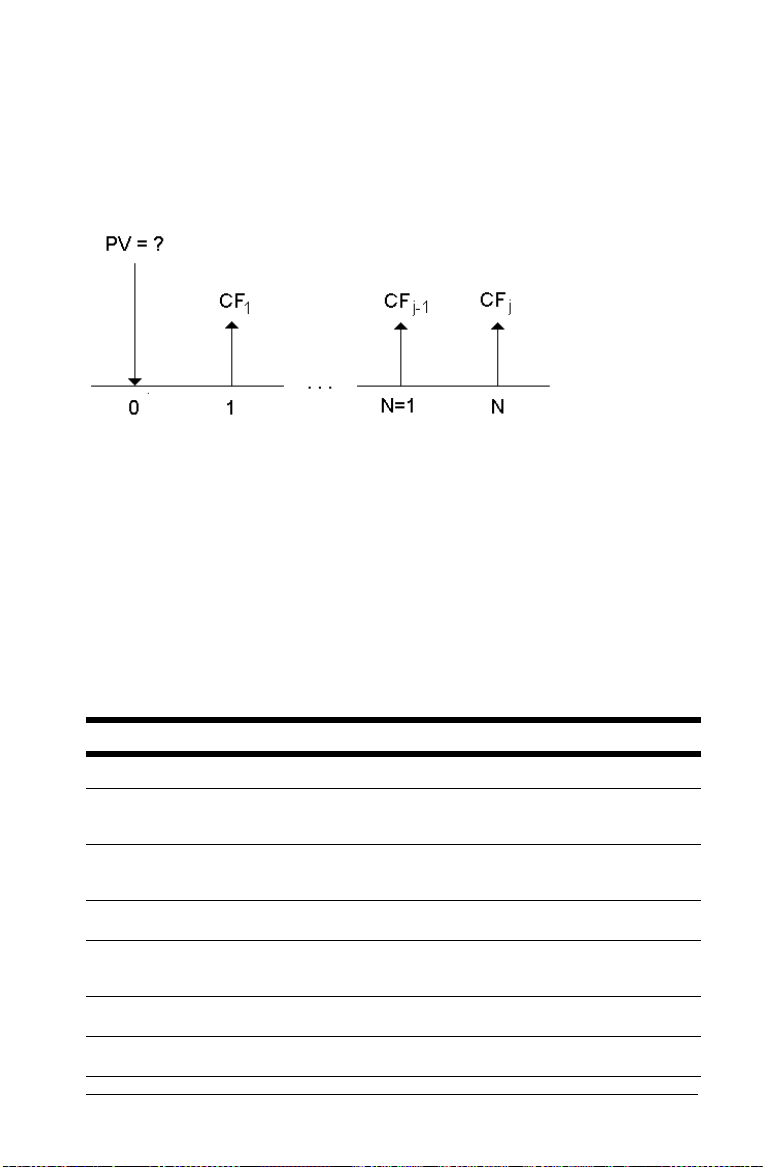

Note: Although variable cash flow payments are not equal (unlike

annuity payments), you can solve for the present value by treating the

cash flows as a series of compound interest payments.

The present value of variable cash flows is the value of cash flows

occurring at the end of each payment period discounted back to the

beginning of the first cash flow period (time zero).

Example: Computing Present Value of a Lease

With Residual Value

The Peach Bright Company wants to purchase a machine currently leased

from your company. You offer to sell it for the present value of the lease

discounted at an annual interest rate of 22% compounded monthly. The

machine has a residual value of $6500 with 46 monthly payments of

$1200 remaining on the lease. If the payments are due at the beginning

of each month, how much should you charge for the machine?

The total value of the machine is the present value of the residual value

plus the present value of the lease payments.

To Press Display

Set all variables to defaults. &}!

RST 0.00

Set beginning-of-period

payments.

&] &V

BGN

Return to standard-calculator

mode.

&U 0.00

Enter number of payments.

46 ,

N=

46.00

1

Calculate and enter periodic

interest rate.

22 6 12 N-

I/Y=

1.83

1

Enter residual value of asset. 6500 S0

FV=

-6,500.00

1

Compute residual present value.

C.

PV=

2,818.22

7

Loading ...

Loading ...

Loading ...