Loading ...

Loading ...

Loading ...

48

Depreciation Calculations

Using depreciation calculations, you can obtain depreciation

base values using three types of calculation methods: the

straight-line method, the sum-of-the-years’ digits method, and

the declining balance method.

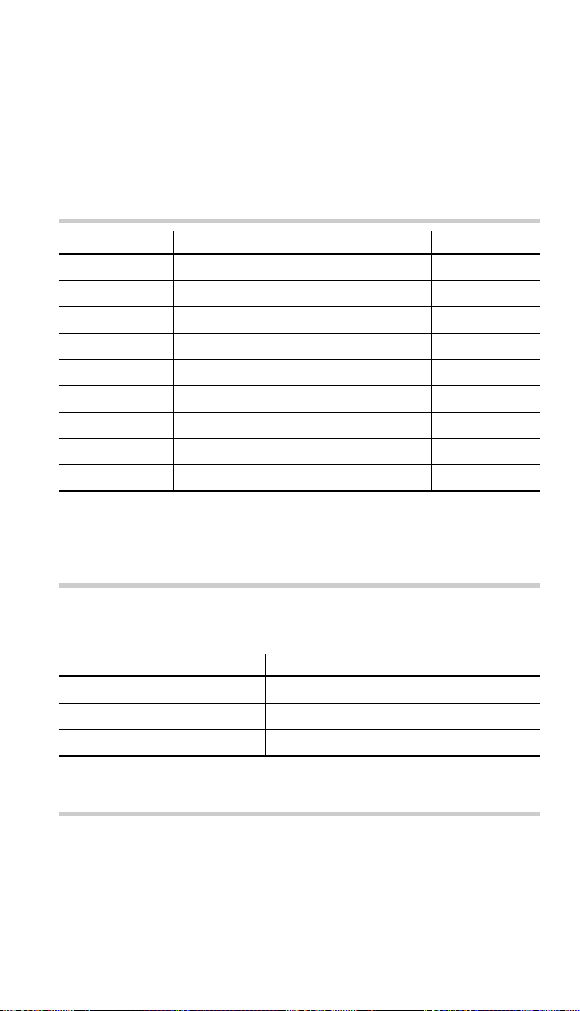

Variables used in depreciation calculations

Variable Description Default value

DB (I/Y) Interest per year 0

LIFE (N) Years of depreciation 1

START MONTH Starting month 1

COST (PV) Cost of asset 0

SALVAGE (FV) Salvage value 0

YEAR

Year for calculating depreciation value

1

DEPRECIATE Depreciation value of above year —

RBV Remaining book value —

RDV Remaining depreciation value —

DB (I/Y) appears only when you select DB (declining balance

method) for the depreciation method.

Setting the depreciation method

• Select the depreciation method in the SET UP menu. It is

initially set to SL.

Key operation Description

~

2

0

SL (Straight-line method)

~

2

1

SYD (Sum-of-the-years’ digits method)

~

2

2

DB (Declining balance method)

Basic operations

Refer to page 19 for basic variable operations.

1. Press

s

to clear the display.

• Make sure the calculator is in NORMAL mode.

*

1

*

1

3FinancialFunctionsCurrent.indd483FinancialFunctionsCurrent.indd48 06.7.108:38:45PM06.7.108:38:45PM

Loading ...

Loading ...

Loading ...