Loading ...

Loading ...

Loading ...

40

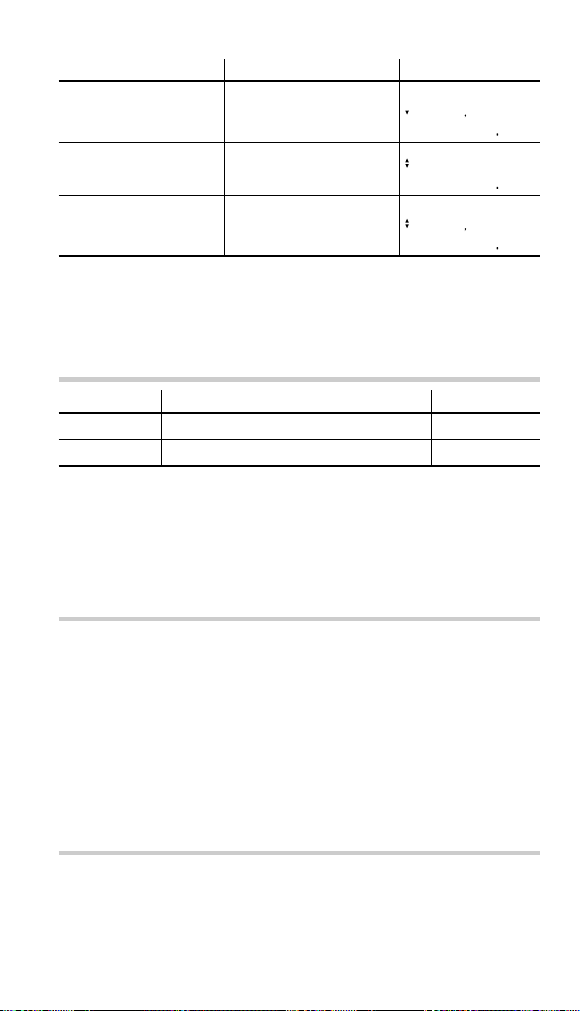

Procedure Key operation Display

Change the fi rst cash

fl ow value from –25,000

to –30,000.

,

30000

J

CF D—=

-3000000

Change the frequency

of 5000 from 2 to 1.

i

i

i

i

i

i

i

1

J

CF N3=

100

Add a new data set

(6000) immediately

before 5000.

.

e

6000

J

CF D3=

600000

To confi rm the corrections, press

.

z

to jump to the fi rst

data item and press

i

to browse through each data item.

Variables used in discounted cash fl ow analysis

Variable Description Default value

RATE (I/Y) Internal rate of return (IRR) 0

NET_PV Net present value (NPV) —

• The variable RATE (I/Y) is shared by the variable I/Y. NET_PV

is for calculation only and has no default value.

• The BGN/END setting is not available for discounted cash fl ow

analysis.

NPV and IRR

The calculator solves the following cash fl ow values:

Net present value (NPV):

The total present value of all cash fl ows, including cash paid out

(outfl ows) and cash received (infl ows). A profi table investment is

indicated by a positive NPV value.

Internal rate of return (IRR):

The interest rate that gives a net present value of zero.

Basic operations

Refer to page 19 for basic variable operations.

1. Press

s

to clear the display.

• Make sure the calculator is in NORMAL mode.

3FinancialFunctionsCurrent.indd403FinancialFunctionsCurrent.indd40 06.7.108:38:35PM06.7.108:38:35PM

Loading ...

Loading ...

Loading ...