Loading ...

Loading ...

Loading ...

43

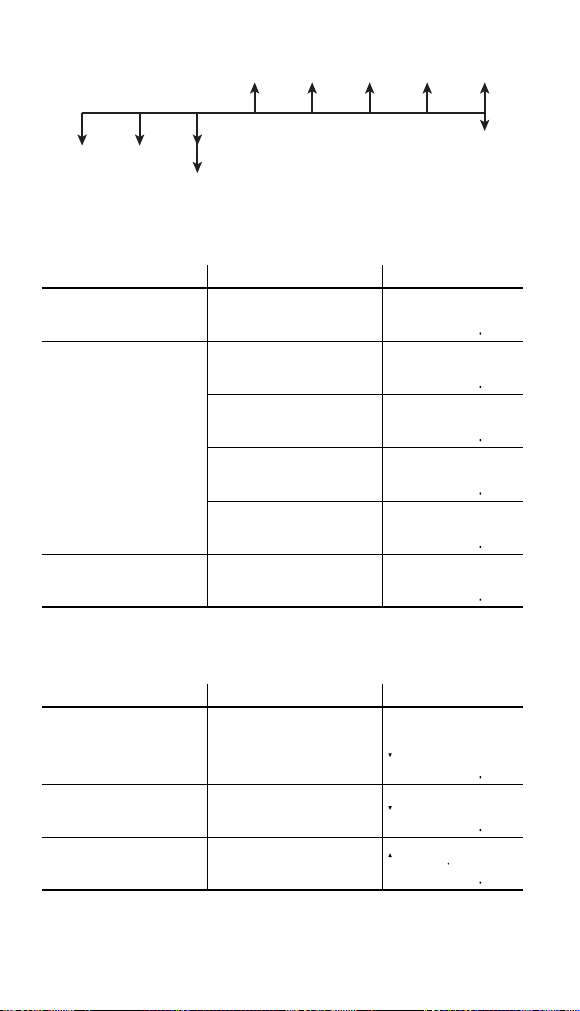

$80,000 $80,000 $80,000 $80,000 $80,000

–$20,000

–

$50,000

–$50,000

–$100,000

–$50,000

1. Enter the cash fl ow data.

Procedure Key operation Display

Bring up the initial dis-

play in NORMAL mode.

s

000

Enter cash fl ow data.

,

50000

>

2

J

DATA SET:CF

000

,

150000

J

DATA SET:CF

100

80000

>

4

J

DATA SET:CF

200

60000

J

DATA SET:CF

300

Return to the initial dis-

play in NORMAL mode.

s

000

If there is cash fl ow data stored, press

>

.

b

to

clear it.

2. Calculate NPV.

Procedure Key operation Display

Select discounted cash

fl ow analysis, and set all

the variables to default

values.

.

<

.

b

RATE(I/Y)=

000

Enter the discount rate.

12

Q

RATE(I/Y)=

1200

Calculate NPV

(NET_PV).

i

@

NET_PV=

662752

Answer: As NPV = 6,627.52 > 0, the product can be developed.

*

1

*

1

3FinancialFunctionsCurrent.indd433FinancialFunctionsCurrent.indd43 06.7.108:38:38PM06.7.108:38:38PM

Loading ...

Loading ...

Loading ...